Thank you to our sponsors who help support this newsletter:

Dex finds you jobs at the hottest AI startups

Work with the most well-connected recruiter in the world:

Scours 10,000+ jobs

Matches you with top tier companies

No form, no cv required

Totally free

Sponsored

Innovate, Disrupt, or Die

Discover how innovation will accelerate your business.

Inner Circle Members can watch the 7-min video explainer, listen to the podcast, and download the learning materials and templates.

Product Metric to Revenue Mapping template

Product Strategy Alignment template

Strategic Evaluation Framework for Features

Feature Priority Strategic Scorecard

Revenue fluency is career critical for you.

Product Managers who connect their work to revenue get invited to strategy. Those who don’t stay stuck in tactics.

Executives don’t want a feature list. They want to know: How does this make us money?

Answer that, and you’re not just shipping features — you’re helping drive the business.

I get some PMs work on non-revenue initiatives — reducing COGS, digital initiatives, “internal products,” to name a few. I’ll get to those in future articles. (Spoiler: those are all tied to revenue or some form of P&L too.)

How Revenue Knowledge Shapes Better Product Decisions

Here’s how revenue fluency pays off you:

1. Connecting Product Metrics to Revenue

DAU/MAU, conversions, activations, adoption, time-to-value (TTV), NPS — they’re all proxies. You need to understand how they link to revenue.

DAU/MAU examples:

Each 1% lift in activation adds 500 retained customers per year. At $5K ARR each, that’s $2.5M ARR.

Your collaboration tool has 60% DAU. This shows it’s part of the team’s daily workflow → lower churn risk → protected ARR.

Your B2B dashboard has an MAU of 8%. At renewal, your client asks, “Why are we paying $100K for something nobody uses?” Result: churn = ARR contraction.

NPS examples:

5 of your enterprise accounts representing $1.5M ARR are scoring an NPS <20. Higher NPS doesn’t always guarantee renewal, but low NPS is a big churn red flag.

“Improving onboarding NPS by 20 points could protect ~$500K ARR by reducing churn.”

“Promoter referrals already generate 15% of new ARR — doubling that is a $3M upside.”

Conversion example:

“Clunky onboarding means only 10% of 1,000 monthly trials are converting = $100K ARR. Improve conversion to 15%, and it jumps to $150K ARR/month — a $600K annual gain.”

Usability/UI examples:

“Our reporting add-on is buried in poor UI, so users don’t discover it. The feature costs us $20K/year. Better access in dashboards helps users see its value, increasing attach rate by 10%. Across 200 accounts, that’s a $4M ARR upside.”

Sales Velocity example:

If an average deal is $100K in ARR and a more easily configurable product demo shortens the cycle by 2 weeks, sales can close an extra 5 deals per year = $500K more in bookings.

Customer Support example:

Poor usability is driving 10,000 tickets/year * $50 per ticket = $500K. Fixing it cuts tickets in half = $250K savings = equivalent of adding $250K in ARR (from a margin standpoint).

Know how to link product metrics to revenue and your product metric is transformed from just “better engagement” to money in the bank.

2. Crafting Product Strategy

Know what revenue streams matter most to the business, and you stop chasing shiny objects.

Example: If expansion ARR (customers buying more seats or add-ons) is the growth engine, focus your strategy on adoption and expansion, not just new logo acquisition.

3. Building Business Cases

Don’t just pitch a feature as “improving retention” or “improving the customer experience.” Attach a currency symbol to it.

Example: “A 3% retention lift = $1.2M in preserved ARR annually.” That’s how you win exec support.

4. Prioritizing Your Roadmap

Not every feature is equal.

Feature A: helps land new customers but only drives $200K ARR annually.

Feature B: improves retention by 5%, protecting $5M ARR.

Which one’s more valuable?

Without understanding the revenue math, you’ll guess wrong.

5. Evaluating Feature Requests

Sales wants Feature X. Customers are asking for Feature Y. Which one do you fund?

Feature X → closes 2 big deals, but little broader impact. Seems risky.

Feature Y → improves usability for all → reduces churn = compounding value.

Always weigh requests by revenue impact.

6. Assessing Trade-offs

Trade-offs are constant.

Build an integration to land one Fortune 500?

Or a self-serve onboarding that boosts SMB conversion at scale?

Revenue impact gives you the lens to decide

Not All Revenue is Equal

Most PMs think revenue is revenue. It’s not.

$1 from a one-time services project is not the same as $1 from a recurring subscription.

$1 from a customer who expands usage every quarter is not the same as $1 lost from a customer who churns after six months.

$1 from a high-margin feature is not the same as $1 that supports a renewal.

Understanding how revenue works and where it comes from impacts everything you do as a product manager:

How it shapes product decisions as in the examples above.

How you link your work to business outcomes that matter.

How you gain buy-in, credibility, and respect among stakeholders and execs.

How you talk about your work, your impact, and your value in performance reviews and job interviews.

How you’re perceived by others.

To help you, over the next several issues, I’m going to do a deep dive on revenue with practical examples of how you can use it for your product work. And I’ve packed this article full of additional learning materials, frameworks, and templates so you can apply the lessons immediately to your work (for paid subscribers).

What You’ll Learn Today:

How revenue knowledge shapes better PM decisions

Revenue concepts PMs need to master

Deep-dive into revenue metrics and how to use them for smarter product decisions

Practical examples of using revenue metrics for crafting product strategy, prioritizing roadmaps, and assessing trade-offs

The 6 core product strategies for every PM

Tools to apply these concepts and strategies to your product

Revenue Concepts You Need to Master

You don’t need to be a CFO, but you do need fluency in the basics. Each type of business has its own revenue metrics. Today, I’ll cover SaaS, and discuss others in future articles.

ARR (Annual Recurring Revenue): The heartbeat of any subscription based business. It’s what the company can count on, year after year, assuming no churn.

CARR (Contracted Annual Recurring Revenue): Like ARR, but it includes signed deals that haven’t started billing yet. Think of it as tomorrow’s ARR already in the bag.

ACV (Annual Contract Value): The average annualized revenue from a single contract. Features that unlock bigger ACVs change the economics of the business. Crucial for enterprise B2B.

TCV (Total Contract Value): The total value of a contract over its entire term, including one-time fees. Important when evaluating big-ticket enterprise features that drive upfront vs. ongoing services.

Bookings: The total value of contracts signed in a given period, regardless of when revenue is recognized. Sales leaders live on bookings.

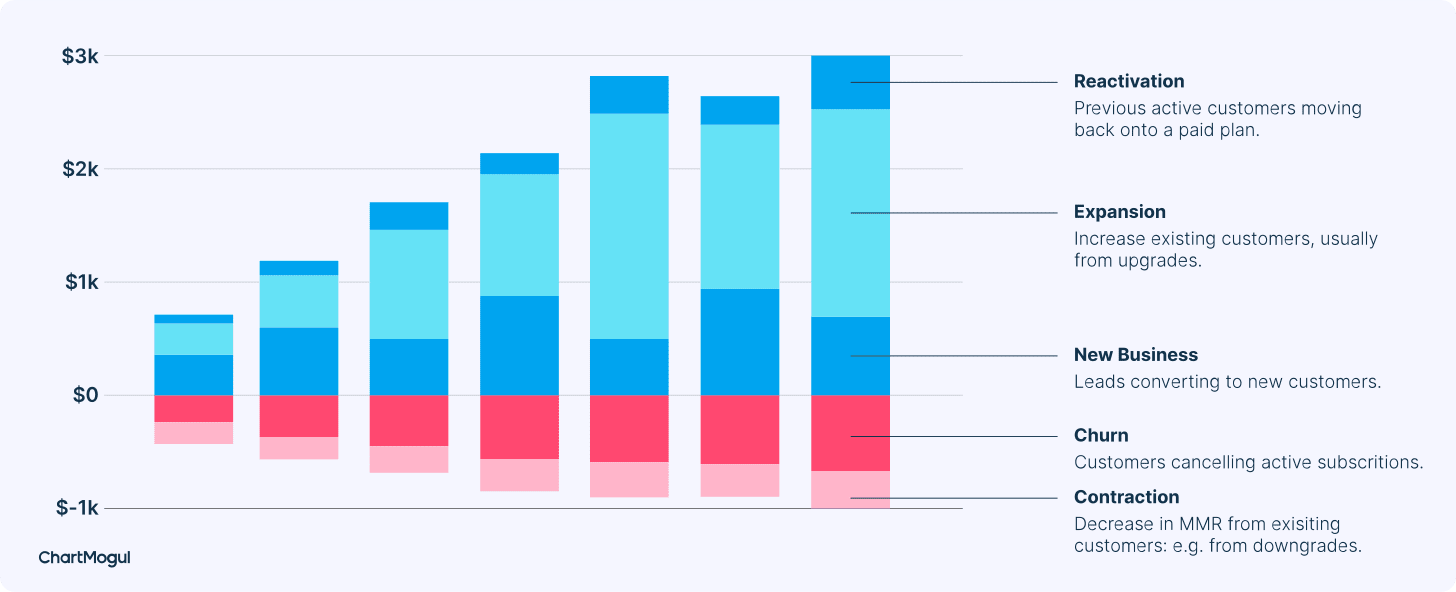

Churn vs. Expansion: Losing customers kills growth; expanding customers compounds it. Features should fight churn and fuel expansion.

Negative Revenue Churn: When expansion revenue from existing customers outweighs revenue lost from churn. Features that drive usage and add-on adoption can fuel hyper growth.

Net Revenue Retention (NRR): Measures how much revenue you keep and expand from your existing base. If NRR > 100%, your product is fueling growth even without new customer acquisition.

ARPU (Average Revenue per User): The average revenue from each paying customer. Driving adoption of premium features or higher-tier plans drives ARPU, which drives ARR.

LTV (Lifetime Value): The total revenue a customer generates before churning. Features that make customers sticky or unlock cross-sell increase LTV — and may justify higher acquisition spend.

CAC Payback: If your feature helps lower acquisition costs or shorten payback, that’s huge.

Gross Margin: Not all revenue is profitable. Features that increase support load or infrastructure cost can erode margins.

Deferred Revenue & Remaining Performance Obligation (RPO): These tell you about committed revenue already booked, which helps you understand stability and risk of future revenue streams.

I’ll start with the basics today: ARR, ACV, and Bookings. I’ll cover the others in future issues.

Most SaaS PMs have heard of ARR and ACV, but they use them interchangeably — few understand how they actually work, let alone how to use them in their product decisions.

Let’s dive in!

Table of Contents

Thank you to our sponsors who help support this newsletter:

Become the go-to AI expert in 30 days

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

1. Annual Recurring Revenue (ARR)

Take all your active subscription contracts today and ask:

“If we annualized the value of all our current contracts, how much subscription revenue would we expect in the next 12 months, assuming they all renew?”

That’s ARR. It’s the annualized value of recurring subscription contracts.

What the does “annualized” mean? It just means, “What would this customer be worth if they kept paying at today’s rate for a full year?”

In plain English, ARR means “what we’re earning on a repeatable basis right now.”

In other words, take the revenue you’re earning right now from a subscription contract and scale it to a 12-month basis.

$1,000 per month → $12K ARR

$3K/quarter → $12K ARR

Partial contract of $6K for 6 months → $6K ÷ 6 × 12 = $12K ARR

Even though you only billed $6,000, the annualized value says: “If this customer kept paying at the same rate for a full year, it would be worth $12,000 ARR.”

ARR is always normalized to a one-year basis. Why? Because it smooths contracts into a yearly number so you can compare apples to apples.

If you launch a feature that drives lots of monthly $500 add-ons, ARR lets you stack that up fairly against an enterprise customer on a $60K annual contract.

Without annualizing, you’d be comparing one month of revenue to one year of revenue, which is nonsense for roadmap trade-offs.

Why ARR Matters:

ARR is the most important growth metric for SaaS companies. It’s essentially a snapshot of the recurring revenue engine at this exact point in time. It’s durable, predictable, and valued highly by investors.

ARR is powerful because it’s essentially an annuity stream the company can count on, as long as they don’t churn the customer.

As such, ARR assumes all contracts that expire during the next 12 months are renewed with existing terms. We assume a customer paying $1,000 per month this year will keep paying the same next year. We assume a customer who signs a 1-year contract for $100K will renew the following year for the same amount under the same terms.

How to Calculate ARR:

A “good enough” version if you need to do a quick back-of-the-envelope estimation:

Total number of customers * Normalized avg amount they’re paying per year

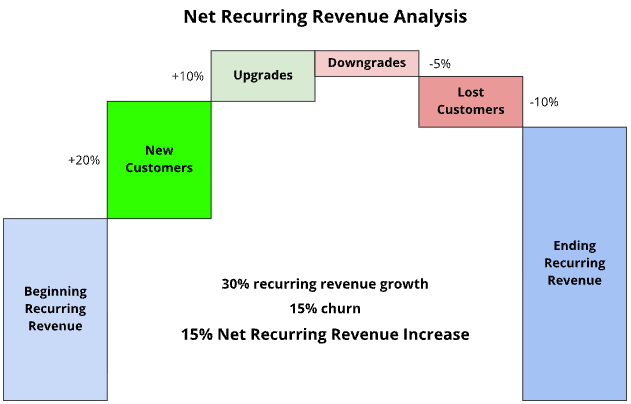

To get a true sense of the health and trajectory of your product, though, you need to track net recurring revenue:

The formula looks like this:

(Beginning ARR + ARR from New Customers + Additional ARR from Upgraded Customers)

MINUS

(Lost ARR from Downgraded Customers + ARR from Lost Customers)

Why net ARR? In our example above, focusing solely on new ARR could lead us to believe our product is growing at 30%. But that would be grossly misleading. The more accurate growth rate is 15%. Because some customers are downgrading and even more are leaving.

Things to include in ARR:

All recurring revenue in that period, including subscription fees and any additional recurring charges for extra users, seats, etc. (based on your pricing model).

Upgrades — customers who upgrade to a higher paid plan in that same period.

Downgrades — customers who downgrade to a lower paid plan in that same period.

All lost recurring revenue — customers you've lost in that period, including any additional recurring fees they were paying for extra users, seats, etc. (based on your pricing model).

Discounts — for example, if your customer is on a $100/month plan, but pays a discounted rate of $75/month, that customer's ARR contribution is $900, not $1200.

Things NOT to include in ARR:

One-time charges — setup and onboarding fees, implementation charges, one-time upgrade fees, etc. While they are part of overall revenue, they're not recurring. You don't expect to receive them on a regular basis.

Non-recurring add-ons — again, not recurring.

Payment processing fees — like credit card, ACH, PayPal, Stripe, or Square fees. It’s tempting to subtract these in order to be more conservative and "accurate". But these fees are an expense, not a loss in revenue.

Trialers — folks on your trial version. Important to track, but they haven’t paid you yet, so they don't yet count toward ARR. Once they pay you, they count.

Delinquent charges — represent failed collections. Again, tempting to include, and important for accurate accounting, but not a necessary level of detail to track top-line growth.

Recurring costs, COGS, and other expenses — ARR is a growth metric, not a profitability metric, so don't include costs.

Because this is about recurring revenue, one-time purchases, non-recurring fees and expenses should be kept out of it.

To track growth over time, some companies build it as a waterfall graph, like so:

How You Can Use ARR in Your Product Work:

You’re debating two roadmap initiatives:

Feature A: Automates customer onboarding for enterprise clients. Expected to generate $500K in one-time services revenue because professional services teams can sell high-touch packages around it.

Feature B: A new subscription add-on that integrates with customers’ CRMs. Expected to generate $200K ARR in its first year.

At first glance, Feature A looks more attractive because the headline revenue ($500K) is bigger. But let’s walk through the lens of ARR:

Compounding Value:

Feature A contributes $500K once. Next year, you need to sell another big onboarding package to see that revenue again.

Feature B contributes $200K every year. In Year 3, it’s already generated $600K and will keep growing with renewals and upsells.

→ ARR favors Feature B’s compounding growth.

Predictability:

One-time services make revenue lumpy and less predictable.

ARR smooths into reliable, recurring revenue streams, which investors and executives prize because it’s an indicator of a sustainable business with predictable cash flows.

→ As a PM, emphasizing ARR growth helps show how your roadmap supports sustainable business performance.

Retention & Expansion:

Features that improve the core subscription (Feature B) strengthen retention, protecting the base of ARR.

Add-on modules often create “stickiness.” If a customer integrates deeply with your CRM module, churning becomes harder.

→ A PM might prioritize Feature B not just for new ARR, but for ARR protection.

Strategic Positioning:

Feature A could indirectly grow ARR by improving customer activation and long-term adoption.

→ Happy, well-onboarded enterprise customers are less likely to churn and more likely to expand.

Improved Sales Motion:

Big enterprise buyers often expect professional services.

Having a scalable onboarding automation feature (Feature A) makes it easier for sales to close larger contracts by bundling in high-touch packages.

→ Feature A may increase sales velocity and close rates, even if the SaaS ARR component is smaller today.

Resource Trade-offs:

Feature A requires ongoing staffing to deliver onboarding services. Costs scale with revenue.

Feature B is scalable software: once built, every customer can use it with little marginal cost.

→ PMs can argue Feature B delivers higher ARR margin contribution, which is just as important as ARR itself.

Capacity Unlock:

Automating onboarding frees up your professional services team’s time. They can take on more clients or higher-value work without hiring as fast, which protects gross margins.

Cash Impact:

$500K of one-time services revenue (Feature A) hits the books quickly.

→ If the company is under pressure to hit a quarterly number (e.g., prepping for fundraising or earnings), that immediate recognition may matter more than long-term ARR.

💡 The Key Insight:

Feature A is about cash now and sales leverage — it isn’t about ARR today, but the infrastructure to support bigger ARR later.

Feature B is about sustainable, compounding growth — building recurring revenue that scales year over year and strengthens retention, expansion, and the long-term health of the business.

2. Annual Contract Value (ACV)

ACV is the average yearly revenue expected from a single customer contract, normalized to 12 months. A critical metric in enterprise B2B SaaS where contracts are multi-year and a single customer could have multiple concurrent contracts.

Examples:

3-year deal @ $100K/yr → ACV = $100K

4-month deal @ $50K → ACV = $150K

Why ACV Matters:

ACV tells you how much recurring revenue each customer contributes annually. It’s an indicator of the anticipated annual revenue from the customer relationship.

Investors and boards love it because it signals the quality of the customer base: higher ACV means fewer customers can drive the same revenue, often indicating stickier, higher margin revenue.

As such, ACV is an indicator of deal size and sales motion.

Lets a company estimate future ARR from signed contracts.

Helps prioritize customer segments — high ACV customers deliver more annual revenue per contract.

Helps evaluate sales ROI — which customer deals are worth the cost of acquisition, onboarding, and ongoing support.

ACV vs ARR:

ARR | ACV | |

|---|---|---|

Definition: | Total recurring revenue the company expects from all active subscriptions, annualized | The annualized revenue from a single contract, normalized to one year. |

Scope: | Company-wide. Adds up revenue from all customers. | Customer-level or contract-level. |

Purpose: | Measures the company’s recurring revenue “run rate”. Used to track growth, retention, and investor metrics. | Helps understand the value of individual contracts and prioritize efforts for high-value clients. |

Example: | 10 customers each paying $100K/year = $1M ARR Reflects all revenue the business is actually counting on for the next year. | 3-year contract worth $300K = $100K ACV Focuses on one customer or contract. |

ARR tells you how healthy the revenue engine is.

ACV tells you which customers are most valuable and where sales and R&D investments can have the biggest impact.

How to Calculate ACV:

Take the recurring subscription portion of a customer contract.

Include any recurring usage-based fees (if predictable).

Annualize it if billed monthly or quarterly or the contract is less than 12 months.

Don’t include:

One-time fees — upfront setup, implementation, or professional services.

Hardware or 3rd party costs.

Non-recurring consulting fees.

These one-time costs are included in TCV — Total Contract Value. So, if a customer signs a 3-year contract worth $300K total and $30K for a one-time implementation:

ACV = $300K ÷ 3 = $100K/year

TCV = $300K + $30K = $330K

Let’s take a slightly more complicated example: A customer signs a 2-year contract for $100K, and then signs another 1-year contract for $25K.

ACV of the 1st contract is $50K

ACV of the 2nd contract is $25K

Total ACV for this customer is normalized to $75K — i.e., this customer is worth $75K in annualized value.

Why would a single customer have multiple contracts? Here’s an example:

Your product helps healthcare providers monitor chronic disease patients. Your ICP is large US health systems. Cleveland Clinic signs a contract to use your platform for their diabetes patients in a 4-month pilot. The pilot goes well, so they sign a new contract to serve the same patient population for 2 years and sign another contract to use your platform for heart disease patients for 1 year.

There are 3 contracts, each with its own ACV.

How You Can Use ACV in Your Product Work:

ACV is contract-level annual revenue, so it’s incredibly useful for prioritizing product work that will deliver the most value per customer. Unlike ARR, which looks at all customers together, ACV helps you focus on high-value deals and segments.

Customer Segmentation

Helps you understand which segments drive the most revenue and where to focus adoption or expansion initiatives.

Capacity Planning

ACV lets you estimate future ARR from signed contracts. That can help you decide where to allocate capacity for product work.

Feature Prioritization

High ACV customers justify building more expensive or complex features (e.g., SSO, advanced reporting, integrations).

Low ACV customers may not justify custom work.

Roadmap Trade-offs

Helps you compare opportunities: supporting a single $1M ACV enterprise contract could be more valuable than dozens of $10K ARR SMB deals.

Let’s take an example. You’re debating two roadmap initiatives:

Feature A: Enterprise-grade reporting and analytics module.

Targeted at large enterprise clients.

Expected to increase contract ACV by $150K/year per customer.

Development effort: 3 months, medium complexity.

Feature B: Self-serve onboarding improvements for SMB customers.

Targets smaller accounts.

Expected to improve ACV by $10K/year per customer.

Development effort: 1 month, low complexity.

Let’s walk this through the lens of ACV:

Revenue Impact per Segment:

Feature A: $150K ACV × 5 enterprise customers = $750K incremental ACV.

Feature B: $10K ACV × 50 SMB customers = $500K incremental ACV.

Even though Feature B helps more customers, Feature A delivers higher revenue impact per segment.

Investment ROI:

Even though Feature B helps more customers, Feature A delivers higher revenue impact per unit of development effort.

Even if Feature A takes longer to build, it delivers higher revenue impact per unit of development effort.

For a company focusing on high-ACV enterprise accounts, the per-customer revenue gain justifies the investment — it’s more efficient than spreading resources thin across many small accounts.

Strategic Focus:

Feature A aligns with the high-ACV enterprise segment, which may have higher retention, lower churn risk, and expansion potential.

Feature B is helpful but primarily impacts low-ACV accounts that may be less strategic to long-term growth.

Sales ROI:

Enterprise features can unlock bigger contracts. Sales can close deals at higher value because Feature A addresses enterprise-specific requirements.

This means relatively greater lifetime value for the cost of acquiring a customer for enterprise vs SMB clients.

Customer Adoption / Impact:

Even if Feature B’s ACV per customer is lower, it improves the product experience for the largest portion of the user base.

Example: Better onboarding could increase SMB retention from 70% → 85%, protecting ~$500K ARR and preventing churn headaches.

Faster Time-to-Value / Quick Wins:

Feature B takes 1 month to build, compared to 3 months for Feature A.

Quick wins can demonstrate momentum to leadership, unlock early ARR, and reduce risk of delays.

Scalability:

Enterprise-grade reporting (Feature A) might require ongoing maintenance, dedicated support, and custom SLAs.

Feature B is self-serve, low-touch, and scales easily without increasing operational costs.

Risk Management & Portfolio Balance:

Investing only in high-ACV enterprise features concentrates risk in a few customers.

Supporting the broader SMB base diversifies revenue and reduces dependency on a handful of large contracts.

💡 The Key Insight:

Feature A is about maximizing revenue per customer and strategic enterprise growth — it’s about unlocking bigger deals, even if it serves fewer users.

Feature B is about broad adoption and scale — expanding and diversifying revenue across many customers.

3. Bookings

Bookings is the total value of contracts signed in a given period (regardless of when the revenue is recognized). It can include recurring revenue, services, one-time fees, and multi-year contracts, depending on how the company defines it.

As such, a booking happens when a customer agrees to spend money with you. That is, when a net new customer signs up or an existing customer renews their relationship with you.

Why Bookings Matters:

Investors and boards like it because it provides a snapshot of sales momentum and a measure of the market demand for your product.

Bookings tell you how the market is responding and committing to your product. This makes it an important leading indicator for measuring the growth of and traction for your product.

In other words, how do you know the product you’re delivering is actually resonating with customers? That’s what bookings can tell you.

Because if your product doesn’t resonate with customers, they won't commit to spending money on it.

Signals Growth Pipeline

Bookings show how much new business the sales team has closed in a period.

High bookings can indicate that new features or product improvements are helping close deals.

Revenue Timing vs. Recognition

Bookings are not the same as ARR. ARR only counts recurring revenue already active and annualized.

Bookings may include multi-year contracts or one-time setup fees that won’t show in revenue until later.

Strategic Product Decisions

Product investments that help win deals faster or larger will lift bookings even before ARR reflects the growth.

Example: A new enterprise module might help sales close a $1M TCV deal today, but only $300K counts in ARR this year.

👉 Bookings align the interests of the Sales and Product teams.

Because bookings are a measure of market demand and acceptance, they’re a relevant business metric to use to motivate the product team to continuously develop amazing features and user experiences to increase customer commitment.

Bookings vs. ARR and ACV

Metric | Scope | Includes | Timing | PM Relevance |

|---|

Bookings | Deals signed | Recurring + one-time fees + multi-year contracts | At signing, regardless of revenue recognition | Measures product’s impact on market traction |

ARR | Company-wide recurring revenue | Annualized recurring revenue only | Based on active subscriptions, recognized over time | Measures sustainable, predictable revenue |

ACV | Single contract | Annualized value of a single contract | Normalizes the recurring portion of multi-year deals to 1 year | Helps prioritize features by high-value customers and segments |

ARR tells you how healthy the revenue engine is.

ACV tells you which customers are most valuable and where sales and R&D investments can have the biggest impact.

Bookings tells you how your product is gaining market traction — i.e., how your product drives sales success.

How to Calculate Bookings:

Identify all contracts signed in the period (monthly, quarterly, yearly).

Include:

Recurring subscription revenue

One-time setup or implementation fees

Multi-year contract value (if recognized as “bookings” in your org)

Exclude:

Revenue from renewals that were booked in a previous period

Revenue that hasn’t been contracted yet

Here’s a simplified formula:

In a given period:

Recurring Contract Value + One-time Fees + Multi-Year Contract Value

Example 1 — 3 new enterprise deals signed this quarter:

Deal 1: 3-year subscription, $300K + $30K setup

Deal 2: 1-year subscription, $120K, no setup

Deal 3: 2-year subscription, $200K + $20K setup

Bookings this quarter = (300 + 30) + 120 + (200 + 20) = $670K.

Example 2 — deals with multiple implementations:

Deal 1: 3-year subscription, $300K + $30K setup

Deal 2: 1-year subscription, $120K, no setup

Deal 3: 2-year subscription, 2 programs, $200K + $20K setup in year 1 for program 1 + $30K setup in year 2 for program 2

Bookings this quarter = (300 + 30) + 120 + (200 + 20 + 30) = $700K.

How You Can Use Bookings in Your Product Work:

Because bookings measure signed deals, not just revenue recognized yet, it gives you actionable insight into how product decisions impact market adoption. This includes net new customers, renewals, and expansions.

This is especially useful for:

Startups and new products that are unproven in the market.

New features meant to drive net new customer acquisition.

Validating defensible differentiation.

Product efforts meant to drive renewals and expansions.

Let’s take an example. You’re debating two roadmap initiatives:

Feature A: expected to close $600K in new bookings by unlocking previously blocked accounts.

Feature B: expected to generate $500K in bookings via upgrades and renewals.

Feature A directly grows the customer base and overall market share.

Feature B boosts revenue from accounts that are already onboarded.

Let’s walk this through the lens of Bookings:

Strategic Segment Expansion & Diversification:

Feature A opens access to customers that were previously untapped, while simultaneously reducing dependency on existing accounts, balancing risk across a larger customer base.

Retention and Churn Prevention:

Feature B adds value keeps existing customers happy and less likely to leave.

Shorter Sales Cycle / Faster Time-to-Value:

Expansion deals (Feature B) often close faster than net new deals (Feature A) because the customer is already live on your platform.

This means faster time-to-revenue for lower sales cost.

Build Volume Pipeline:

If market penetration or market share growth is the priority, the promise of Feature A may help build up the sales pipeline, fueling ARR later.

💡 The Key Insight:

Feature A is about expanding the footprint — driving new customer acquisition and generating new streams of revenue.

Feature B is about driving predictable ARR growth — increasing stickiness and maximizing revenue from existing customers.

The 6 Product Strategies

Every product strategy can be boiled down to these:

Accelerating bookings (faster sales cycles)

Adding ARR (higher conversion)

Protecting ARR (reduce churn)

Growing ARR (expansion, upsell)

Increasing ACV (maximize customer value)

Improving margin (profitable revenue) —> we’ll talk about this in the future

Take This With You

When you understand these revenue concepts, you can:

Speak the language of executives. Saying “this improves NPS” is nice. Saying “this protects $3M ARR” is gold.

Prioritize smarter. You’ll know which features deliver recurring, high-margin revenue vs. one-off wins.

Avoid traps. You won’t get fooled by one-off requests or shiny objects,

Align strategy. You’ll build features that strengthen the company’s most valuable revenue streams.

The next time you’re reviewing your roadmap or assessing a feature request, ask:

What revenue stream does this impact?

How big is the impact (in a currency symbol)?

Is it protecting revenue, generating, or expanding revenue?

What are the trade-offs in margin, cost, or customer risk?

That’s how you shift from a backlog manager to a trusted business leader.

Because great product management isn’t just about building features or moving product metrics.

It’s about building revenue.

That’s all for today.

Have a joyful week, and, if you can, make it joyful for someone else too.

cheers,

shardul

Whenever you’re ready, there are 4 ways I can help you:

Inner Circle Membership: In addition to weekly battle-tested real-world PM tactics and strategies to take control of your career, get unlimited community events access, a strategic resume review, and exclusive PM Exchange roundtables. We’re not just building a community, we’re building a movement. Upgrade here.

One Week Product Roadmap: Learn to design a clear, outcome-driven roadmap in just 7 days — fast, practical, and stakeholder-ready. Read the reviews here.

Corporate Training & Strategy Workshops: Transform scattered priorities into a clear, actionable strategy through a customized workshop or level up your product team to think strategically, craft impactful roadmaps, and deliver results that matter. Book a call.

Improv Based Team Building Workshop: Boost creativity, trust, and collaboration through improv. Your team will problem-solve faster and work better together. Book a call.

Shardul Mehta

I ❤️ product managers.